The warehouse industry is on the fast-track to becoming fully automated because of the many benefits of automated materials handling. But it can come at a high price if you have to finance the cost of robots or automated guided vehicles (AGVs) up front. Now global financial solutions expert DLL has cracked the code on how companies can reduce the financial impact of investing in automated materials handling.

McKinsey predicts that around 57% of existing warehousing and logistics functions will be automated and handled by a variety of robots and machines in the future.

Huge benefits

In the long run, AGVs are much more efficient and cheaper than using a labor force in many circumstances: they work 24/7 and get no overtime. That is why many large companies have already made the switch to automated warehousing operations. Benetton, for example, claims to spend € 0.45 cents on end to end logistics for a piece of clothing. This was in large part achieved through automatization, which allowed them to work more shifts and improve quality control. Porsche also improved its throughput time and cut error rates when it built its fully automated mega spare parts center in Sachsenheim, which currently supplies 3.2 million order lines per year.

High financial risk

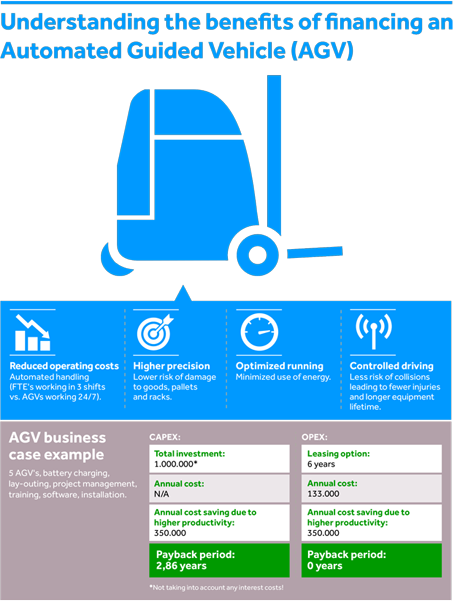

But most companies struggle with the high initial investment of switching to automation. “A single AGV unit can cost up to € 200,000 when you include engineering, software and installation, which is much higher than a standard forklift,” says Marco Wagner, VP Fleet Solutions at DLL. “These technologies are relatively new and are often very customer specific, so leasing companies have been reluctant to step into this market. As a result, most companies have to pay for this investment up front, and it might take them up to 5 or 10 years to earn that money back. In practice, it can take even longer because many manufacturers require advance payments during the 7-12 months it can take from the moment the order is placed to the moment the unit is operational.”

New leasing options

Drawing upon its long experience in asset-based financing for materials handling and industrial equipment, DLL has cracked the code on financing warehouse automation equipment. “We are a market leader in financing forklift fleets in many regions of the world,” says Wagner. “We used the same principles that we applied to forklift leasing to come up with a leasing option for AGVs, which when you think about it are essentially an automated version of the traditional forklift. With this AGV leasing contract, a customer pays a fixed fee per month, with no money up front, and their bottom line can immediately benefit from increased efficiency. By avoiding an up-front capital outlay, the return on investment goes from several years to 0. Any advance payments can also be included in the lease, which eliminates another drain on capital outlay.”

Successful projects

Wagner says, “The results we have achieved in financing laser-guided AGVs and palletizing robots for our customers prove that this approach works. This market is rapidly growing and the need for smart financing solutions will become even more important in the future. We are currently expanding our offering to cover all types of automated material handling equipment. By providing flexible, usage-based financial solutions we help to drive down the total cost of operation (TCO). This enables our customers to continue to innovate and grow.”