Leverage a suite of financial solutions

Financial solutions for businesses

Commercial finance offers a suite of financial solutions, customized to meet diverse business needs and enable uninterrupted product flow throughout the sales cycle.

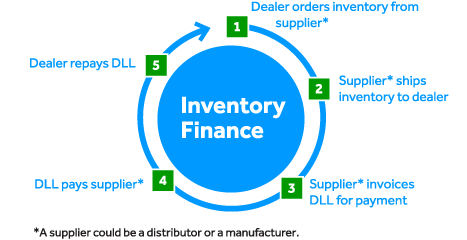

Inventory finance

Inventory financing allows businesses to align and schedule payments with cash flow forecasts, based upon seasonality, market demand or your business needs.

This solution is typical for Scheduled Payment Programs (SPP) and Pay as Sold (PAS)

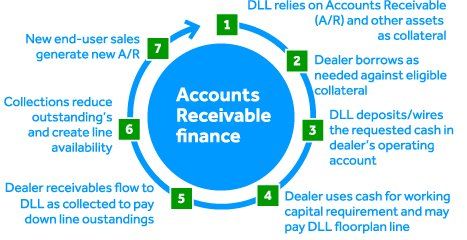

Accounts Receivable

The formula driven line of credit is self-liquidated by the collection of all the customer’s A/R into a Lock Box. Existing DLL partners can borrow up to 85% on eligible Accounts Receivables (A/R), 100% on Floor Planned Inventory or 50% against Used Equipment.

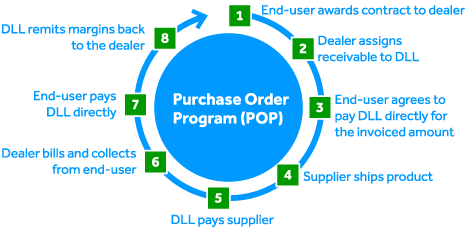

Purchase Order Program

POP transactions are secured to the terms of payment from the end user. This is a common financial solution for the Public Sector.

Schedule Payment Program (SPP) Solutions

Input/Consumables finance

The assets financed are of a consumable nature and often seasonal, with financing timed to meet demand. Enabling repayment terms to be consistent with dealer and channel income streams.

Examples: seeds, copier toner, or hospital supplies

Export finance

DLL will sign an export financing agreement with vendor, providing flexibility to extend terms to their partners in countries where DLL may not be represented.

Rent to buy

Allows a customer to rent the solution for a certain period before they pay the amount due.

Parts finance

Varying credit periods are designed to ensure that both fast moving and slow-moving parts can be in inventory to meet end user demand

Bridging

Ability to finance the supply chain, from the sale to delivery period, enabling the dealer to maintain cash flows while completing installation actions.

Pay as Sold (PaS) Solutions

New equipment finance

Allows partners the ability to have inventory on hand and ready for sale when an end user is ready to buy. New Equipment financing is asset specific and identified by a serial number or unique identifier.

Used equipment finance

Offers partners the ability to finance used equipment sourced generally as a trade in against new products and can include used products that have been purchased. Commonly used for larger ticket, slow moving products.

Rental fleet finance

Ability to finance equipment for a short-term rental to the end user

Demo finance

Provide flexibility to demonstrate equipment to partners while accessing extended credit terms

Import finance

Provides the importing dealer/channel with a period of subsidized interest free credit to allow for ordering of products. Financing commences upon delivery of the products but can cover the delivery period

Contact us to learn more about solution implementation

How it works

Inventory finance

Accounts receivable finance

Purchase Order Program

Inventory Finance: Scheduled Payment Programs (SPP)

Align and schedule payments with cash flow forecasts, based upon seasonality, market demand or your business needs.

Input/Consumables finance

- The assets financed are of a consumable nature and often seasonal, with financing timed to meet demand. Enabling repayment terms to be consistent with dealer and channel income streams.

- Examples: seeds, copier toner, or hospital supplies

Export finance

- DLL will sign an export financing agreement with vendor, providing flexibility to extend terms to their partners in countries where DLL may not be represented.

Rent to buy

- Allows a customer to rent the solution for a certain period before they pay the amount due

Parts finance

- Varying credit periods are designed to ensure that both fast moving and slow-moving parts can be in inventory to meet end user demand

Bridging

- Ability to finance the supply chain, from the sale to delivery period, enabling the dealer to maintain cash flows while completing installation actions.

- The Bridging Loan is repaid from lease proceeds and will continue as a lease with the end user.

Inventory Finance:

Pay as Sold (PAS)

Set the payment to the time of sale to match the channel partner’s cash flow.

New equipment finance

- Allows partners the ability to have inventory on hand and ready for sale when an end user is ready to buy.

- New Equipment financing is asset specific and identified by a serial number or unique identifier.

Used equipment finance

- Offers partners the ability to finance used equipment sourced generally as a trade in against new products and can include used products that have been purchased. Commonly used for larger ticket, slow moving products.

Rental fleet finance

- Ability to finance equipment for a short-term rental to the end user

Demo finance

- Provide flexibility to demonstrate equipment to partners while accessing extended credit terms

Import finance

- Provides the importing dealer/channel with a period of subsidized interest free credit to allow for ordering of products.

- Financing commences upon delivery pf the products but can cover the delivery period

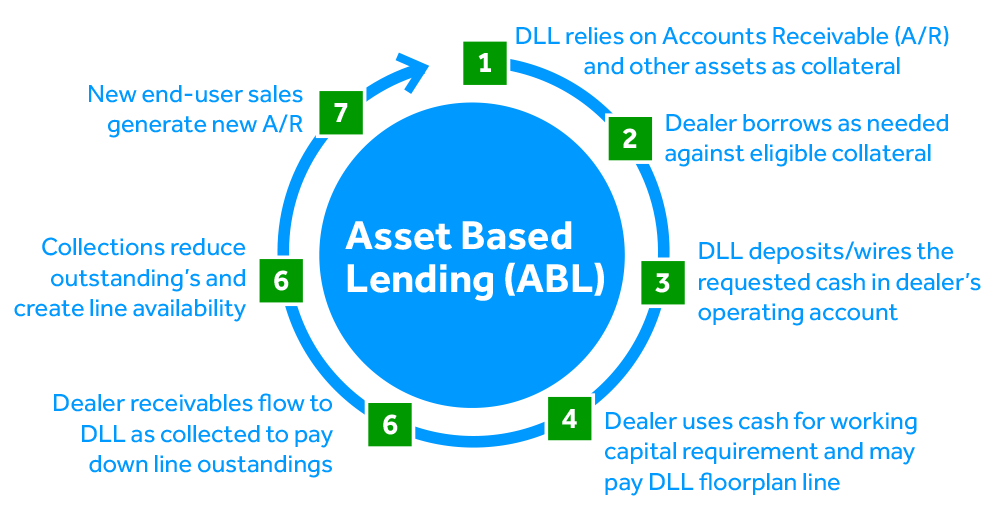

Asset-Based Lending

Increase cash flow with a comprehensive working capital line of credit.

New equipment finance

- The formula driven line of credit is self-liquidated by the collection of all the customer’s A/R into a Lock Box. Existing DLL partners can borrow up to 85% on eligible Accounts Receivables (A/R), 100% on Floor Planned Inventory or 50% against Used Equipment.

Purchase Order Program (POP)

- The transaction is secured to the terms of payment from the end user

- Common financial solution for the Public Sector.