Use payment flexibility to capture and retain more customers

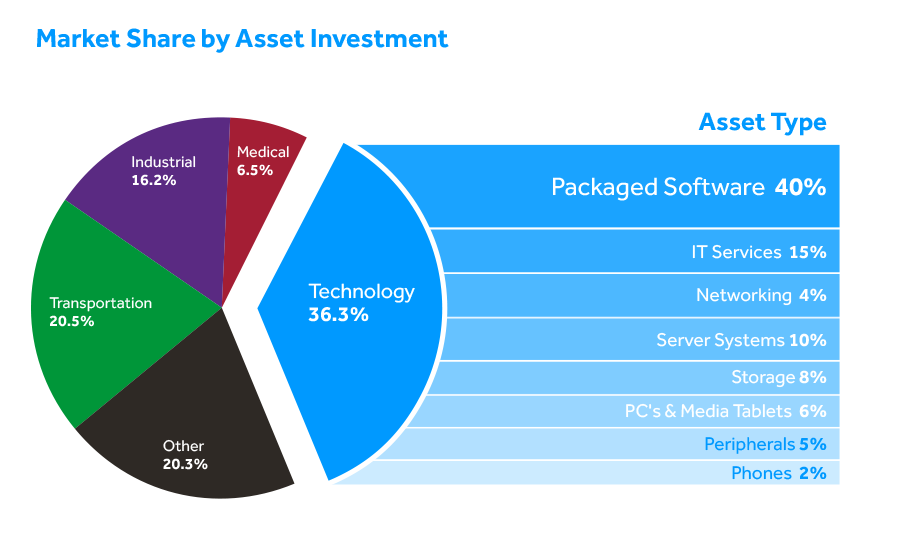

Software licenses and subscriptions represented 40% of all technology financed in the US. Why? Payment flexibility allows customers to manage IT budgets, ROI considerations, and cash flow.*

Financing is the most prevalent method to acquire software licenses and subscriptions

Software licenses and subscriptions represented 40% of all technology financed in the US. Why? Payment flexibility allows customers to manage IT budgets, ROI considerations, and cash flow.*

Method of Software Financing*

Value of software payment solutions

Payment solutions that are tailored to the unique requirements of your customer can help them:

- Acquire more licenses today without budget creep

- Take advantage of volume discounts while locking in price

- Match the payment terms to the utilization and accelerate ROI

- Empower business line decision-makers

- Improve forecasting

- Streamline renewals by removing the traditional expense spikes

- Acquire more licenses today without budget creep

- Take advantage of volume discounts while locking in price

- Match the payment terms to the utilization and accelerate ROI

- Empower business line decision-makers

- Improve forecasting

- Streamline renewals by removing the traditional expense spikes

“If the license has a three year term, even fortune 500 companies would prefer to make payments over three years in order to match the payments with the use of the product.”

– William Veatch, Morrison Foerster (Source: The Monitor Nov/Dec 2014)

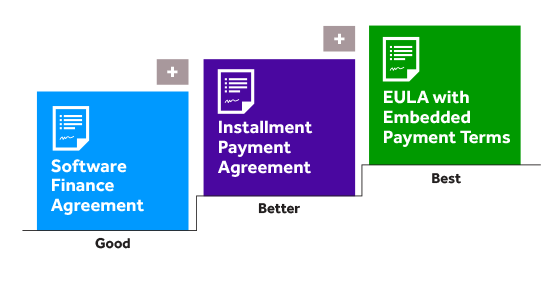

Flexible contract options

Your catalyst for flexibility.

Monthly, quarterly, semi-annual, and annual payment structures, payment deferrals, seasonal and ramped payments, and non-appropriation of funds for SLED.

What can be financed?

- Perpetual license

- Term license

- Single and multi-year subscription

- Single and multi-year maintenance

- Term license

- Single and multi-year subscription

- Single and multi-year maintenance

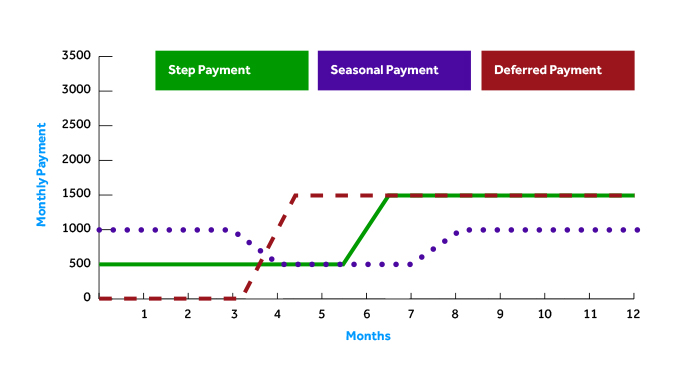

Flexible payment structures

Step payment:

- Lower payments to start contract

- Match payments to project cash flow

- Step up or down and predictable

- Lower payments to start contract

- Match payments to project cash flow

- Step up or down and predictable

Seasonal payment:

- Payments match seasonal cash flow

- Flexible and predictable

- Payments match seasonal cash flow

- Flexible and predictable

Deferred payment:

- No payment to start

- Typically deferred 90 days

- Fixed payment for remainder

- No payment to start

- Typically deferred 90 days

- Fixed payment for remainder

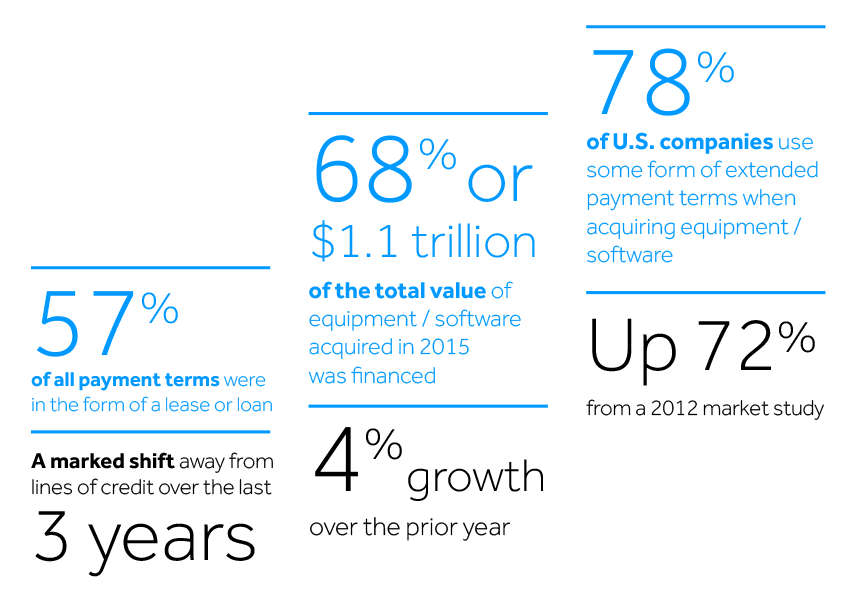

How U.S. companies view payment solutions

Why DLL?

*Stats referencing 2016 report.

Get further insight

Feel confident with a global finance leader

With 50 years of experience, DLL understands the unique needs of our partners around the world—and offers proven solutions to help businesses thrive.