Although leasing is becoming increasingly important to companies, its presence on accounting documents is far from transparent. Under current accounting standards, leased assets and liabilities are often kept off the balance sheet, distorting the picture of the financial strength, value and performance of a company. Early 2016, the International Accounting Standards Board (IASB) and US Financial Accounting Standards Board (FASB) released new IFRS 16 lease accounting standards that will be effective as of 1/1/2019. The new lease accounting standard will kick start a new chapter in leasing and fundamentally change how companies account for leases. IFRS 16 will deliver transparency and a truer picture of a company’s assets and liabilities.

The new standard - IFRS 16

The primary departure from the current standards is that companies reporting under IFRS or US GAAP (Generally Accepted Accounting Principles) will now be required to account for operating leases with lease terms of more than 12 months, on their balance sheets.

The new lease standards will be implemented retroactively. Contracts that qualify as operating leases and expire after January 1, 2019 that are currently off the lessee's balance sheet will need to be on the balance sheet for the remainder of the contract. Therefore, if you are reporting under IFRS or FAS/ US GAAP, you will need to have comparative figures for 2017 and 2018.

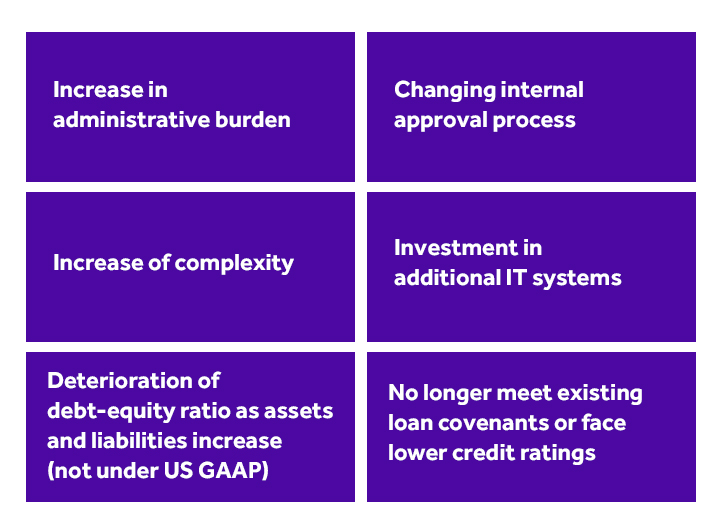

How will IFRS 16 impact your business?

How can you prepare for the new standard?

- Set up project structure

- Educate your network

- Take an inventory of your lease and rental contracts so you can better determine the potential impact on your business (rental offices, Lease cars, copiers/printers, hardware, software, furniture, etc.)

- Contact your IT systems and software providers to discuss the consequences for your proprietary and third party systems and software

- Prepare accounting policies & procedures

- Prepare your transition strategy

- Include accounts in ledgers

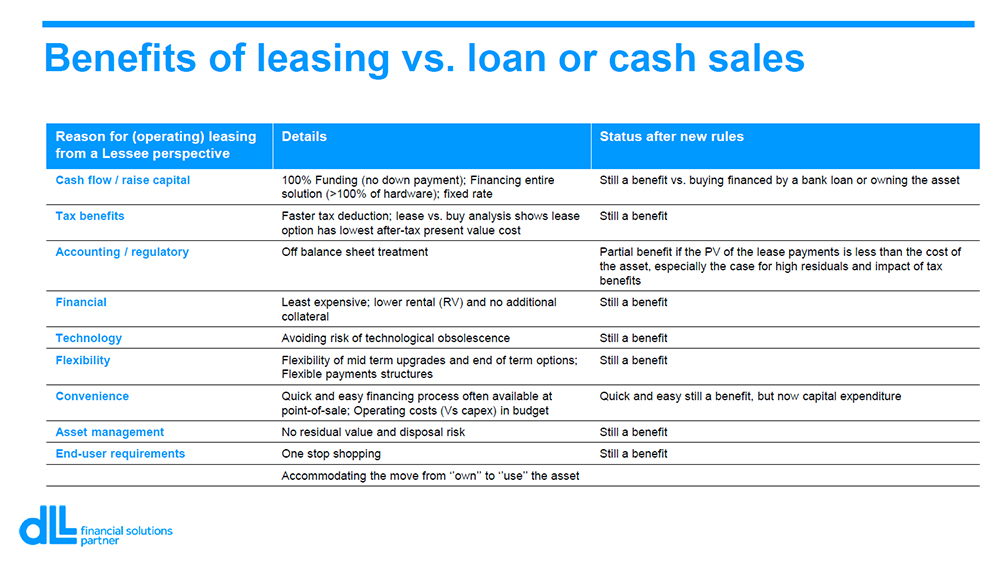

Consequences of the new standard on leasing

The new standard will launch a new era in leasing. While companies will be required to learn the new standard and implement new processes, leasing will continue to be an attractive solution for optimizing business opportunities. DLL has outlined the benefits of leasing under IFRS 16: