In today’s changing market, ensuring the stability of the supply chain can sometimes feel like a moving target. Throughout the channel, we see that demand ebbs and flows faster than ever before, customers expect to receive products quickly, and cash preservation remains top of mind.

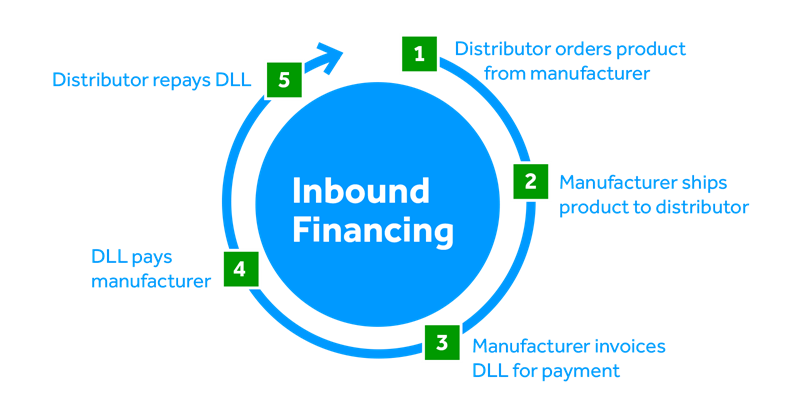

One solution to address today’s evolving supply chain expectations is financing directly through the manufacturer, also known as inbound financing. With inbound financing, manufacturers can better support their distributors’ unique needs. Whether a distributor is looking to quickly acquire more product, keep a more robust inventory, take advantage of flexible, extended payment terms or better manage cash flow, inbound financing offers manufacturers a competitive advantage by helping move more products through the channel and ensuring timely payments.