This year marks a time of change for equipment and technology suppliers and lessees. The new U.S. ASC 842 accounting standard has already taken effect for publicly traded companies and is required for private companies by 2020. For the first time ever, nearly all lease obligations must be listed as assets and liabilities on company balance sheets.

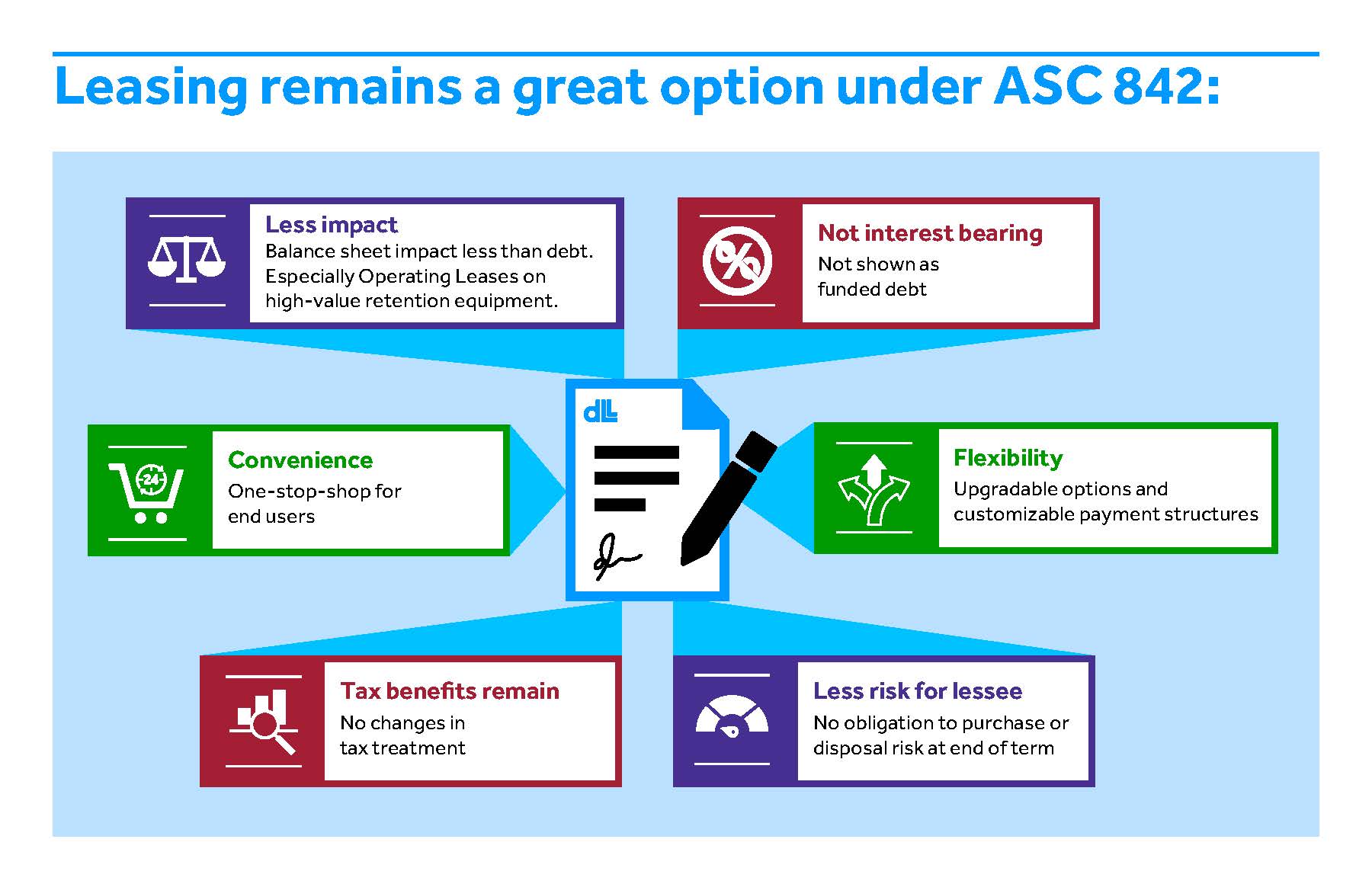

Adoption is complex. But while meeting the standard requires new processes and reporting capabilities, leasing advantages still remain strong.