Today’s buyers expect more from their suppliers than ever before. With businesses being so dynamic, buyers expect flexible procurement options, along with holistic solutions and data insights that improve operational efficiency. As their output levels change, particularly in the current environment, then buyers also expect the amount they pay for their working assets to align with their actual usage of those assets.

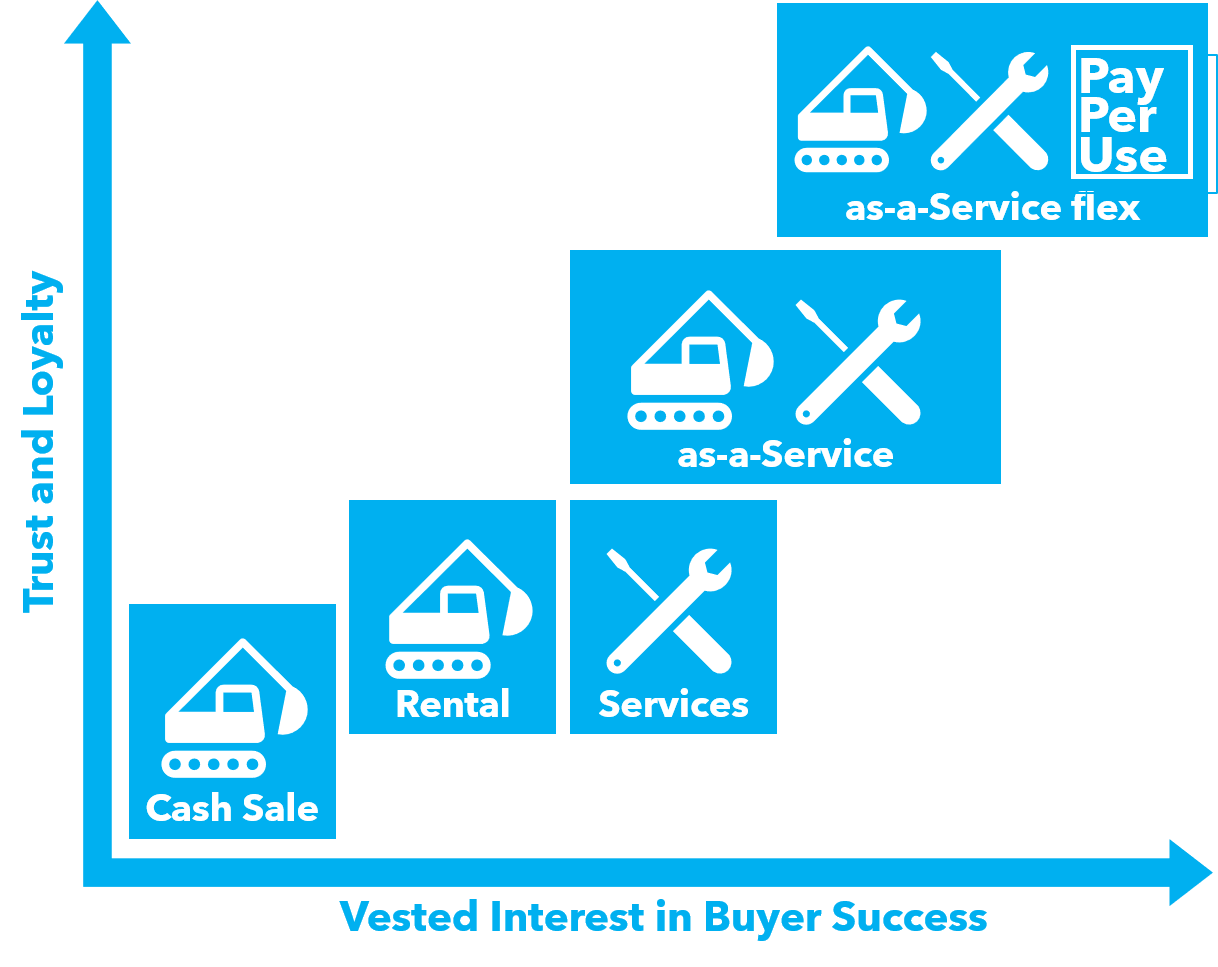

The most successful buyer-supplier relationships involve a high level of trust – the buyer wants to be assured the supplier has a vested interest in the success of his business. When it comes to the provision of services, this holds true as the supplier will naturally only get to perform those services for the buyer if the buyer’s business is successful. In other words, if the buyer is still in business over time and the buyer has used the assets to a level sufficient for them to require servicing. Compare this to the supply of the asset alone, and the supplier’s vested interest in the buyer’s success weakens. Why? First, the asset will have been sold on day one of the relationship, either by way of cash sale to the customer or by sale to a funder that has taken over the credit risk in the buyer. Second, the payment received for the asset does not correlate to any usage of the asset by the buyer, that is, payment is the same irrespective of whether the asset has been used a lot (likely meaning the buyer’s production is up and that their business has done well) or sadly, not very much at all.

Relate this to the consumer market. If I want to buy an iPhone, I pay £1000 for the handset and the deal is concluded on day one. The shop has my £1000, and the shop does not care if I go bankrupt tomorrow. If however I sign up to receive the iPhone with a service pack for an all-in payment of £29.99 per month, then the shop cares.