Welcome to the first edition of our new Tech Solutions blog series: Tech Trends. Throughout the series, we’ll address some of the latest trends, hot button issues and common themes in tech financing including: device financing, cloud payment solutions and As-a-service offerings. We hope you’ll enjoy, and thanks for following along!

Tech Trends: How Channel Partners are Thriving in Today's Market

Nov 11, 2019

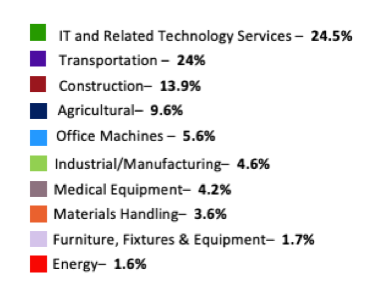

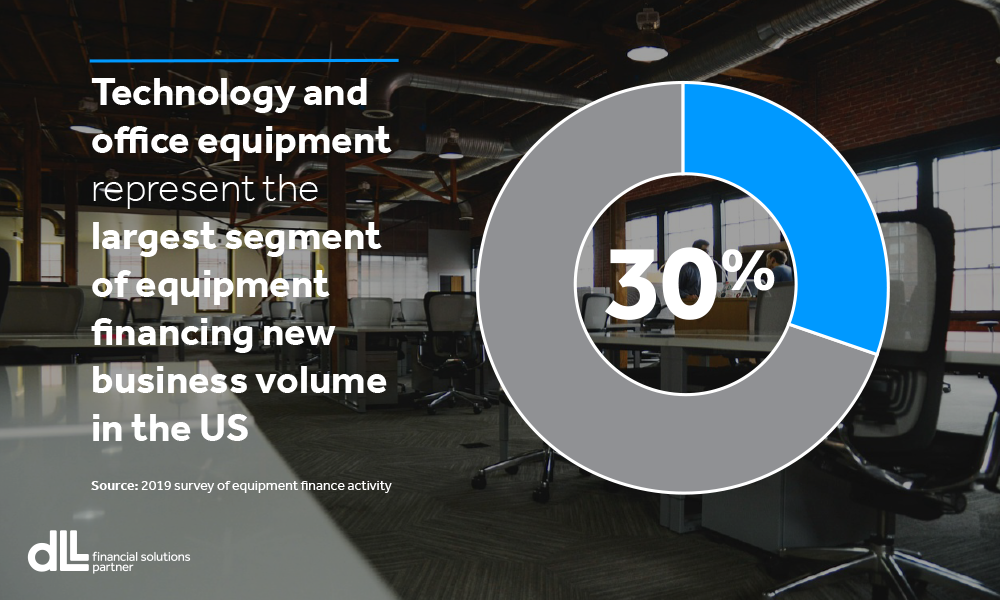

It comes as no surprise that the Equipment Leasing and Finance Association’s (ELFA) 2019 Survey of Equipment Finance Activity reported that in 2018, Technology Solutions and Office Equipment combined accounted for just over 30 percent of all equipment financing new business volume in the United States. PCs, software, devices and IT networking equipment top the list of products financed.

Tech Flexibility

At the speed at which technology moves, obsolescence is inevitable. However, different customer payment solutions, such as leases, installment payments or Device-as-a-Service (DAAS) provide customers more flexibility and access to upgrades, freeing them from the ties to owning outdated technology that is potentially slowing down their business. For example, when a business purchases laptops for its employees, the technology will eventually be replaced by newer models; updated operating systems will emerge and certain software will no longer be compatible on older models. When a business finances or leases laptops instead, it gives them the freedom to stay current and upgrade to the latest models, meaning fewer IT hurdles and more time spent on what matters most to the business.

Tech Financing

According to the Equipment Leasing & Finance Foundation’s s 2019 Equipment Leasing & Finance Industry Horizon Report end-user survey, 79 percent of respondents used some form of financing to acquire technology and software. Of the financing methods used leasing, lines of credit and device as a service were among the most popular for technology product acquisitions. Leasing preserves lines of credit, leaving more capital available and avoids the need for a large outlay of cash up front. For resellers in the channel, their customers are able to obtain all of their technology needs, often in one place. Device-as-a-Service allows organizations to scale up device deployment, or down, depending on the needs of the business. With DaaS, organizations can upgrade devices more easily, and in a cost-effective manner, without being burdened by device management. By offering financing solutions, resellers can outperform their competition, increase individual sale amounts and sales volume.

Reseller Solutions

Offering payment solutions allows resellers to help their customers efficiently manage their tech assets. At DLL, we understand the power of tech financing and deliver customized and flexible payment solutions for manufacturers, channel partners and their customers. Are you offering payment solutions to your customers? Equipment financing is all DLL does, and we do it well.

To learn how DLL can help your business, contact our team.