Hiten Sonpal, Global Head of Business development, Energy Transition

Integrating Automation and Energy Investments

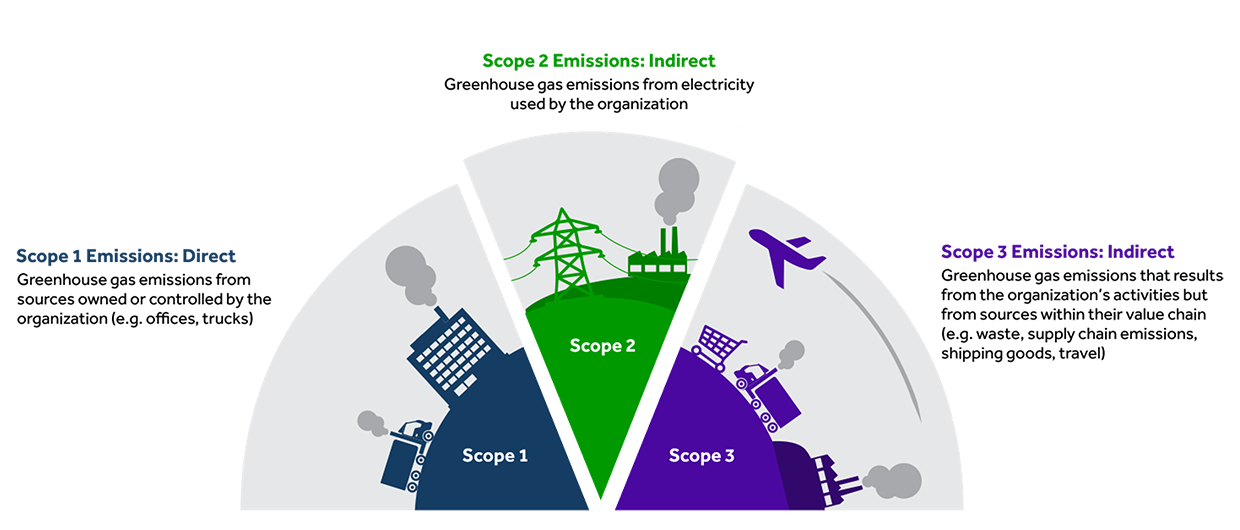

When you align automation upgrades with on-site clean energy, you unlock far greater operational and sustainability benefits than by pursuing each in isolation. Bundling intralogistics equipment – robotics, racking, and LED lighting – with renewable power systems maximises carbon reductions across both Scope 2 and Scope 3 emissions, streamlining capital planning and ESG reporting.

Rather than financing each asset separately, companies can combine them into a single, blended solution. One repayment schedule and one finance partner mean a consolidated view of cost, carbon savings, and performance, simplifying the business case and accelerating implementation.

Innovative Financing Models

New funding structures are emerging to unlock these capital-intensive, high-ambition projects. Traditional bank loans may not fit the bill for fast-moving tech upgrades or energy builds. Instead, solutions like operating leases and project finance help companies preserve capital and smooth cash flow by reducing upfront outlay. In many cases, lease payments can be treated as operating expenses, providing budget flexibility.

Tailored leases can include all project elements – not just hardware but also software, integration, training, and installation – so soft costs aren’t excluded. Companies can even align payments with seasonal revenues (paying more during busy months and less during quiet periods), which eases cashflow strain.

In addition, blended finance approaches combine public incentives with private capital. Governments routinely offer subsidies, tax credits, or value added tax (VAT) deferrals for green assets (for instance, reduced VAT on solar installations or grants for EV chargers). By stacking these incentives with bespoke finance, a business can effectively lower the net cost of deployment.

Similarly, emerging models like Energy-as-a-Service and pay-per-use allow companies to access the latest tech without owning it, further reducing financial risk. In all cases, the goal is scalability and flexibility: to enable multi-phase upgrades and cross-border projects that traditional single-asset loans might not support.

Strategic Partnerships and Tailored Finance Solutions

Working with the right finance partner can transform complex projects into seamless upgrades. By aligning expertise in intralogistics and energy transition, a single provider can understand the operational realities of warehousing alongside the technical nuances of renewables – simplifying planning and execution for customers.

Global reach and local adaptability are equally important. Whether navigating EU sustainability standards, tapping into national energy-transition subsidies, or meeting regional green-build codes, DLL – with a presence in more than 25 countries – can scale projects and optimize incentives across borders.

The real benefit comes when warehouse automation equipment and energy transition technology are financed under one umbrella. Customers avoid juggling multiple contracts, timelines, and repayment schedules; instead, they gain a consolidated solution that matches their cashflow patterns and ESG targets.

DLL’s blended finance solutions cover everything, from renewable energy systems and EV chargers to advanced automation and intralogistics equipment, all in one bespoke package. By aligning asset lifecycles and payback periods, DLL ensures maximum ROI for the combined project and removes the complexity of managing multiple loans or partners. This unified approach lets you electrify, automate, and decarbonize your supply chain swiftly and confidently.

Rather than simply providing capital, DLL’s integrated teams collaborate with manufacturers, system integrators, and sustainability consultants to blend leases, loans, and public incentives into the ideal package. This approach lets logistics operators focus on growth and service excellence, confident that financing complexity is handled on their behalf.

By treating automation and clean-energy investments as complementary, businesses unlock greater returns and faster carbon reductions. A tailored finance structure from DLL can align repayments with the project’s expected energy savings and efficiency gains to reflect realised savings, helping customers begin to see positive cash-flow impacts from day one after installation.

Ready to electrify, automate and decarbonise your logistics operations? Let’s build the future together. Contact DLL today for a partner who brings sector insight, international scale, and flexible funding models to your sustainability roadmap.

Learn more here