Reprinted with permission from the Equipment Leasing & Finance Association.

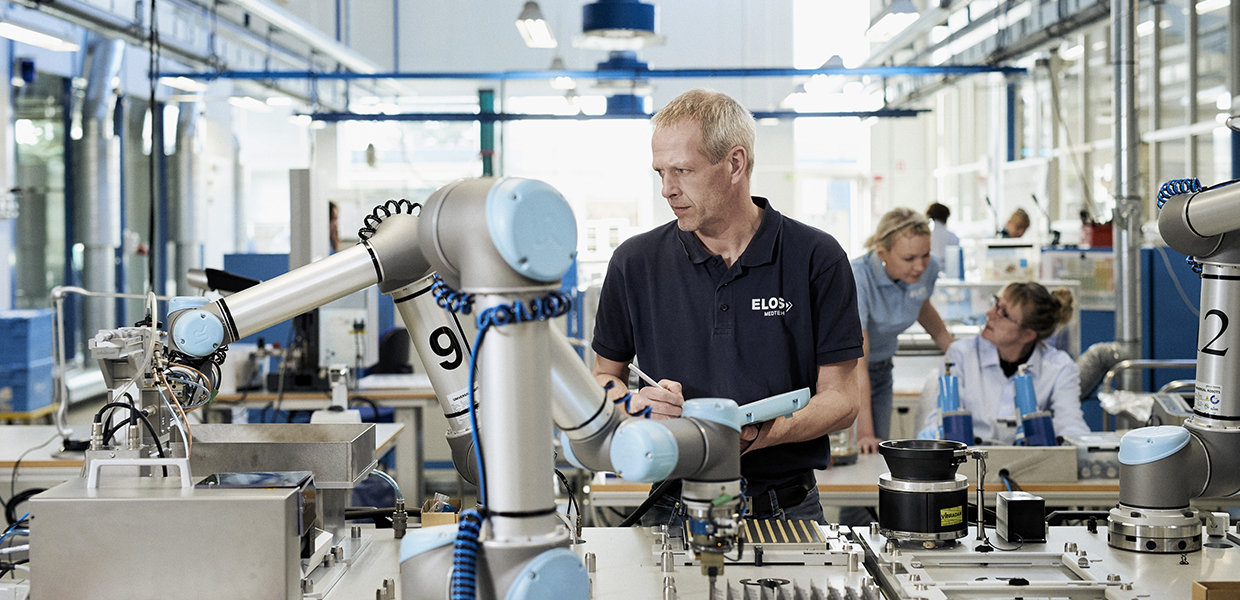

IF THE PANDEMIC WAS A BRONCO THAT THREW MOST OF THE MARKETS AND MANAGERS TRYING TO RIDE IT IN EARLY 2020, it was a tired horse later, accepting nibbles of recovery and creativity as the year wore on. But make no mistake: 2020 was, in the words of one equipment manager, “a most unusual year” as restaurants did business out of the back door, delivery services partnered with competitors to move critical supplies and warehouses couldn’t add automated equipment fast enough to cope with the explosion in e-commerce. Observed another asset manager, “Times are changing, jobs are changing and the way we work today is not the way we worked a year ago—and it probably won’t be how we work a year from now.”“COVID-19 was the wildcard for 2020, and we expect it to be the same in 2021,” summarizes Nick Coscia, Equipment Manager for Asset Management, Americas at DLL in Wayne, Pennsylvania. “But we expect the availability of vaccines to usher in some stability, and we’re taking an active approach to help customers manage the life cycle of their equipment.”

New Roads, Familiar Destinations

If 2020 turned equipment management inside out, it also forced widespread adaption and innovation, just to continue doing business. “Everything is different, but the same,” says Jane Rethmeier, CEO of Harbor Capital Leasing, Inc., an Independent specializing in financing material-handling equipment. “COVID-19 caused shut-downs for many of our lessees last spring, resulting in some stagnation for us. But customers were adapting to conditions by summer, when they realized they had too much equipment or equipment that wasn’t in the right place. So many lessees moved equipment to locations where they had more demand. Once everyone got into the groove and found a new, temporary normal, we got really busy—and it’s been this way since August.”

Tom Monroe, Senior Vice President of Asset Management at ATEL Capital Group, a San Francisco-based Independent that finances heavy equipment, has also seen much more new business since summer. “I think a lot of companies were waiting for the election,” he says. “And because manufacturers had made adjustments for COVID-19, it took several months longer for them to deliver new equipment. But the delays gave customers more time to decide how to replace their fleets, and this resulted in longer renewals.”

Phil Houser, Director of Asset Management at CIT in Livingston, New Jersey, says that in commercial construction the pandemic led to supply delays, altered strategies and investor pull-back on project decisions because of uncertainty. “Industry intelligence on the heavy-equipment market talks about new construction orders being down from a year ago and manufacturers shifting to produce medical supplies,” he says. “But as this happened, the used-equipment and rental-equipment markets benefited. Prices for used equipment, based on condition for lower hours of service, were at a premium.”