A global company with broad expertise and local market knowledge, DLL is agile enough to assume Residual Value risk, even on very specialist equipment. For example, in the logistics industry, DLLwill collaborate closely with a business to understand how it operates and what it needs, to be able to provide a tailored solution that works.

DLL has close partnerships in the industry, which ensures that a finance solution can be provided for large investments from the outset. For example, for a warehouse automation project, DLL can finance all of the assets required, from racking, to robotic equipment, to AGVs, to warehouse software. The integration of smart financing from DLL at the start, helps more projects, such as automation rollouts, come to fruition before they are rejected for being too great a capital expense on the customer’s balance sheet. A recent example of close collaboration was where DLL was involved in the early stages of a project, together with the manufacturer and the customer, to consult and calculate the stage payments at the point of designing a warehouse for new AGVs.

Another great example of DLL supporting businesses with specialist assets, was with Picnic in Germany. Picnic was founded by four entrepreneurs who had a vision for creating a more cost-effective and sustainable way to get groceries delivered, based on a modern milkman system. Today, they have built a successful online supermarket, powered by a smart app, green fulfilment centers and clean electric delivery vehicles. When Picnic continued to expand its German operations in 2019, they turned to asset financing specialist DLL to help finance its large fleet of delivery vehicles. See the full story.

3.Reducing TCO with a new approach

Achieving a reduced Total Cost of Ownership is a key driver for many businesses who need to know how the value of an asset will change and how that will impact their balance sheet. This is an especially complex calculation when trying to compare a lease, to an outright purchase, or finance via a bank loan. Plus, it is necessary to consider depreciation of the asset, and what can be done with it at the point of depreciation.

It is impossible to predict what the future holds, as demonstrated by the Covid-19 pandemic. However, with industry-wide expertise, DLL brings the insight of working with a variety of companies globally and combines that with local market understanding to provide leasing options that take away much of the uncertainty. Whether that is simply a matter of what happens when an asset reaches the end of its lease or is unexpectedly not needed anymore. DLL finance solutions are based on extensive data that indicates how the asset’s value will change, reducing risk, and providing businesses with flexible solutions so they do not have to carry unwanted equipment on their balance sheet unnecessarily.

This reassurance enables businesses to invest confidently in technology that enables them to do their job better. It also allows facilities and equipment to be updated more frequently, keeping businesses functioning as productively and profitably as possible, ready to adapt to new developments and technologies to further improve efficiencies and profitability.

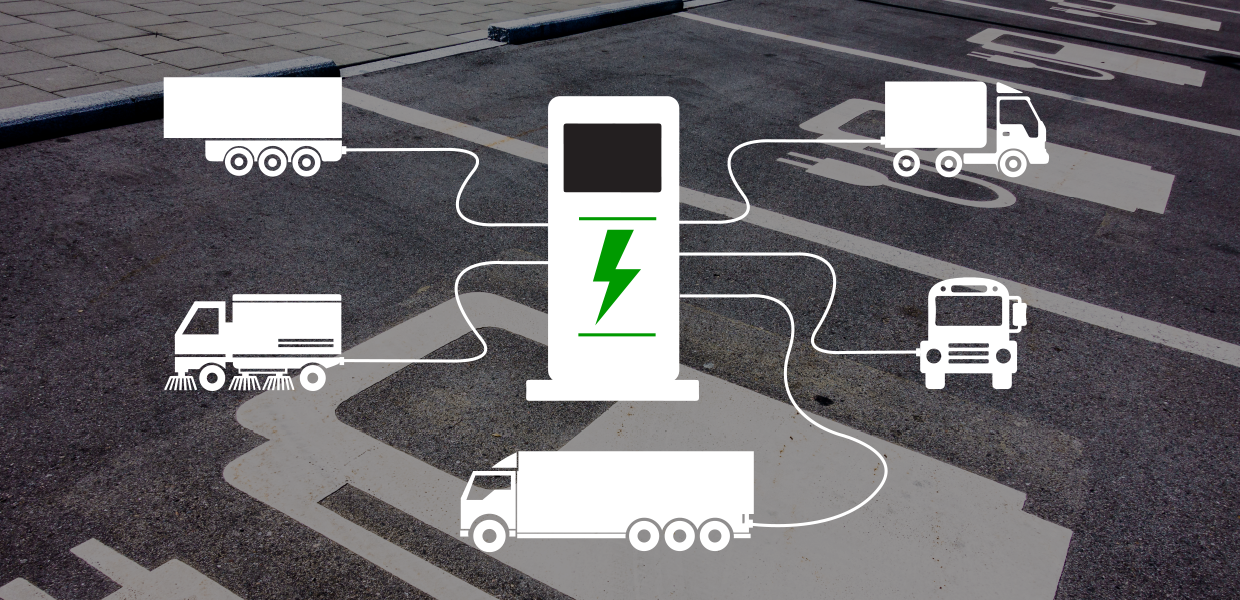

DLL always takes a consultative approach, considering the genuine customer needs and looking at the benefits to each application to find the solution that fits. To this end, DLL has recently been educating many customers about the benefits of moving from traditional ownership, to usage-based models, such as ‘pay-per-use’ leases, which may be more cost-effective than traditional leasing or ownership, while still providing flexibility. Interest is growing in these developments in many sectors, from waste management to construction.

Ready to learn more?

The right solution will always completely depend on a business’s particular needs. Contact our Fleet Solutions team now to discuss how we can help you. Or visit our Fleet Solutions web page.